The Future of DeFi: Opportunities and Challenges in Cryptocurrency

In recent years, the world of finance has witnessed a significant shift towards digital currencies and decentralized financial (DeFi) protocols. Cryptocurrencies like Bitcoin, Ethereum, and others have been transforming the way people think about money, trade, and financial transactions. Decentralized finance (DeFi), which involves lending, borrowing, trading, and other financial activities on blockchain technology, has emerged as a key aspect of DeFi. This article explores the opportunities and challenges associated with cryptocurrency and DeFi.

What is Cryptocurrency?

Cryptocurrencies are digital or virtual currencies that use cryptography for security, decentralization, and immutability. They operate independently of central banks and governments, allowing users to send, receive, and store value without intermediaries. The most well-known cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

The Rise of DeFi

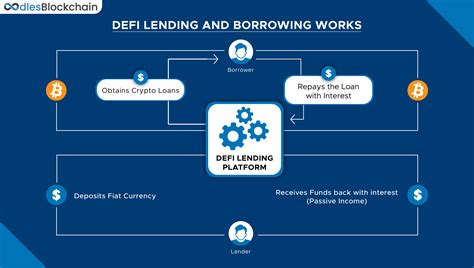

DeFi protocols have been gaining traction since 2017, with the launch of decentralized exchanges (DEXs) like Uniswap and MakerDAO. These platforms enable users to trade assets, borrow money, or engage in lending without traditional intermediaries. The DeFi ecosystem has expanded rapidly, driven by the increasing adoption of cryptocurrencies, blockchain technology, and smart contracts.

Opportunities in Cryptocurrency

- Decentralization: Cryptocurrencies offer a high level of decentralization, allowing users to control their own assets and transactions without relying on central banks or governments.

- Speed and Low Costs: Transactions are processed quickly and cheaply, making it possible for people to participate in financial markets without significant barriers.

- Increased Security: Blockchain technology ensures the integrity and immutability of transactions, reducing the risk of fraud and cyber attacks.

- Diversification: Cryptocurrencies offer a new asset class for investors seeking diversification in their portfolios.

Challenges in Cryptocurrency

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving and often unclear, leading to uncertainty and risks for users and investors.

- Volatility: Cryptocurrencies are known for their high volatility, making it challenging to predict price movements and manage risk.

- Scalability Issues: Many DeFi protocols face scalability issues, which can lead to congestion, slow transaction processing times, and increased fees.

- Security Risks: As with any digital asset, there is a risk of security breaches or hacking attacks in cryptocurrencies.

Future Outlook

The future of cryptocurrency and DeFi looks promising, with several key trends driving growth:

- Increased Adoption: More financial institutions are adopting cryptocurrencies as a means of payment or storing value.

- Advancements in Technology: Improvements in blockchain technology, smart contracts, and decentralized applications will continue to drive innovation and adoption.

- Regulatory Frameworks: Governments around the world are starting to establish regulatory frameworks for cryptocurrencies, which will help to mitigate risks and promote growth.

- Growing Ecosystem: The DeFi ecosystem is expanding rapidly, with new protocols, exchanges, and platforms emerging to meet user needs.

Conclusion

Cryptocurrencies and DeFi have come a long way since their inception in 2009. While there are still challenges associated with these technologies, the opportunities for growth and innovation remain significant. As the DeFi ecosystem continues to evolve, it is likely that cryptocurrencies will play an increasingly important role in the financial landscape of the future.