The Role of AI in Improving Cryptocurrency Trading Performance

As the cryptocurrency market continues to grow and evolve, traders are looking for ways to increase their profits and reduce their risks. One area that has gained significant attention in recent years is the use of artificial intelligence (AI) in cryptocurrency trading. In this article, we will explore the role of AI in improving cryptocurrency trading performance.

What is AI?

Artificial intelligence refers to the development of computer systems that can perform tasks that would normally require human intelligence, such as learning, problem-solving, and decision-making. AI algorithms can analyze vast amounts of data, identify patterns, and make predictions or take actions based on these insights.

The Role of AI in Cryptocurrency Trading

In cryptocurrency trading, AI is used to analyze market trends, predict price movements, and optimize trading strategies. Here are some ways AI improves cryptocurrency trading performance:

- Pattern Recognition: AI algorithms can recognize patterns in market data, such as trend lines, support and resistance levels, and other indicators. By identifying these patterns, traders can make more accurate predictions about future price movements.

- Predictive Analysis: AI-powered predictive analysis models can analyze large amounts of data to identify potential trading opportunities. These models can take into account factors such as market sentiment, economic indicators, and news events to predict price movements.

- Risk Management

: AI algorithms can be used to monitor risk levels in real time and make adjustments to stop-loss orders or other risk management strategies as needed.

- Automated Trading: AI-powered trading platforms can automatically execute trades based on pre-defined rules and parameters, allowing traders to focus on higher-level decision-making tasks.

Benefits of Using AI in Cryptocurrency Trading

The use of AI in cryptocurrency trading offers several benefits, including:

- Improved Accuracy: AI algorithms can analyze vast amounts of data to provide more accurate predictions about market movements.

- Increased Efficiency: Automating repetitive tasks and optimizing trading strategies using AI can free up traders’ time to focus on higher-level decision-making.

- Improved Risk Management: AI-powered risk management tools can help traders manage risk levels more effectively, reducing the likelihood of significant losses.

- Competitive Advantage

: Using AI in cryptocurrency trading can give traders a competitive advantage over those who do not use this technology.

Examples of Successful AI-Powered Trading Platforms

There are currently several successful AI-powered trading platforms available in the market, including:

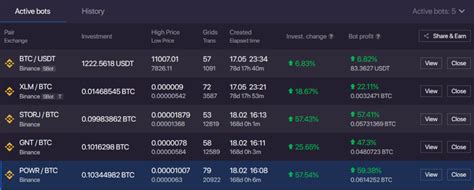

- Binance: Binance’s automated trading platform uses AI to execute trades based on pre-defined rules and parameters.

- Huobi: Huobi’s trading platform uses AI-based predictive analytics models to identify potential trading opportunities.

- BitMEX: BitMEX’s trading platform uses AI to automate risk management and optimize trading strategies.

Conclusion

The use of AI in cryptocurrency trading is becoming increasingly popular, offering several benefits that can help traders improve their performance and reduce risks. By analyzing market trends, predicting price movements, and optimizing trading strategies using AI algorithms, traders can gain a competitive advantage over those who do not use this technology.

As the cryptocurrency market continues to evolve, it will be interesting to see how AI-powered trading platforms continue to develop and improve in the coming years.